Ecommerce Apparel Returns. A USD $168bn Problem

8 November 2022

by Isabelle Ohnemus

Image: Pixabay

In 2021, retail sales of apparel and footwear worldwide amounted to over USD$1.5 trillion. This figure is forecast to increase to almost USD$2 trillion by 2026.1 For the same period, the global e-commerce fashion industry reached an overall market of USD$668 billion and is expected to reach a value of USD$1.2 trillion by 2025.2

The post-Covid-19 effect is clearly present in the projections with the global e-commerce apparel market expected to grow at a compound annual growth rate of 7.9% from 2022 to 2028.3

Covid-19 lockdowns, closure of brick-and-mortar stores, along with shoppers’ personal concerns for their safety and health fueled the evolving expectations of a modern consumer market. No longer able to visit stores and try on clothing, shoppers were forced to go online. Lenient returns policies, extensions in the window for returns, and free shipping for both delivery and returns all encouraged this change in consumer behavior. It was therefore inevitable that these behavioral changes combined with the sheer increase in online sales would lead to a significant increase in the volume of returns. The genie is out of the bottle.

Returns accounted for 16.6% of total US retail sales in 2021, up from 10.6% in 2020.4 Between 2020 and 2021, retailers in the UK also recorded a 39% increase in returns.5

Narrowing the focus, the fashion industry reports average return rates of 25% to 30% for online shoppers.6 In the US alone, clothing items made up 26% of all returned products during 2021, while in some online apparel markets the return rates can be as high as 50%.7

A simple extrapolation applying the lower bounded fashion industry return rate of 25% to the value of the global ecommerce apparel market value of USD$668 billion yields a staggering USD$168 billion in returns.

Returns are now the new normal and are central to the customer experience.

Motivations for returns in the size & fit space

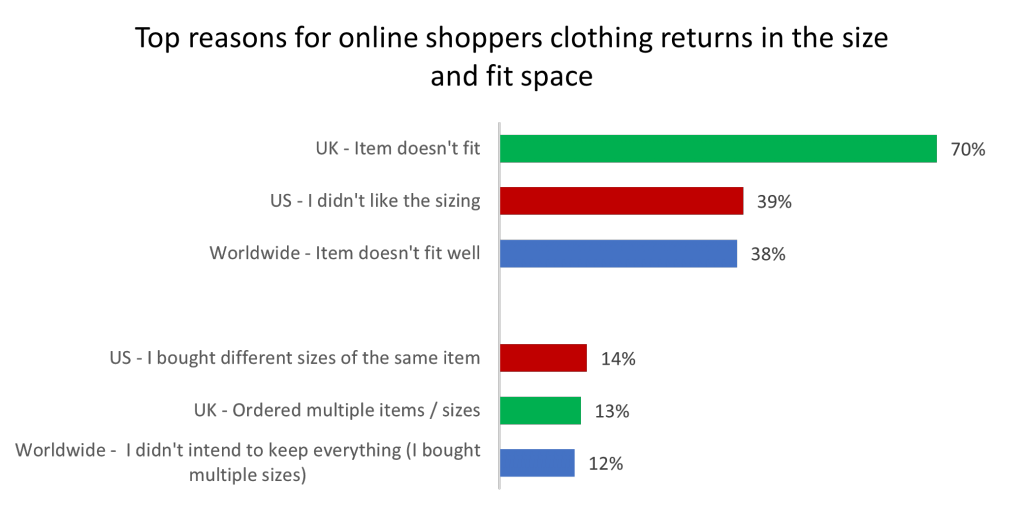

While the returns experience may vary across regions, and your business may fall above or below these averages, the chart below provides a benchmark against which you can evaluate the performance of your business.

Garments that failed to match the product description also featured prominently in the list of reasons online shoppers returned their purchase, scoring 14%9 and 49%10 across the US and UK markets respectively. Although not related directly to garment fit, the information contained in the product detail page is key to the online shopper making an informed product choice.

No such thing as a free return

Research as far back as 201211 found that customers having to pay for returns decreased their subsequent spending with the same retailer by 75% -100% by the end of two years, whereas customers who had free returns increased their spending by 158% – 457%.

More current research indicates that 70% of shoppers say that if a preferred retailer stopped offering free returns they might not shop with them, while 75% of shoppers agreed that free returns mean they will buy more from a retailer over time.12

Clearly, the reluctance of online retailers to needlessly lose customers in the face of such research explains their willingness to cover the costs associated with free returns in a global industry characterized by intense competition and which generated USD$668 billion in revenue in 2021.2

However, such willingness comes at a price, both from a financial and environmental perspective. The tide may be turning. While they may not be the first to adopt such a policy, the decision taken by Zara and Boohoo to introduce a charge for returns13, if only nominally, may represent a tipping point in the fashion industry as more prominent brands follow suit.

As brands tentatively explore the impact charging for returns has upon their revenue and customer base there are other strategies that may be applied in tandem, and which may contribute to the mitigation of size and fit related returns.

Strategies to mitigate size & fit related returns

There is no silver bullet that will solve the returns conundrum. Instead, a combination of strategies, deployed in conjunction with charging for returns presents themselves as online retailers attempt to mitigate the level of returns without losing customers.

◆ C-suite responsibility – In an earlier post I made the case for the Chief Returns Officer. A senior leader tasked with end-to-end responsibility for both processing as well as reducing the volume of returns. A dedicated returns executive is becoming an imperative in an industry that experiences average return rates of between 25% – 30% globally.

◆ Proven technology – The EyeFitU SizeEngineTM patented multi-parameter algorithm and the power of machine learning combine user-generated data, your size charts, and our proprietary global dataset of body measurements to help shoppers find their perfect size and fit.

◆ Product detail pages – Make product information accurate and easy to find. If the product arrives differently than expected, there’s a high chance of it being returned. Provide customers with a diverse selection of fit models showing clothing from different angles.

◆ Customer feedback – Encourage customers to leave honest feedback such as user-submitted reviews and photos about the fit and quality of the ordered items.

◆ Know your customer – Ecommerce platforms capture a wealth of anthropometric and behavioral data about customers supporting targeted, personalized, and specific marketing messages, as opposed to those that are more generic and less effective in reducing the risk of an incorrect choice in so far as size and fit are concerned.

◆ Leverage returns data – Understand the root causes of returns. Data in the form of reason codes collected in-store and online create a feedback loop to inform product design and assortment planning.14

◆ Educate the consumer – In my recent post, I explored the challenge faced by the fashion industry and its contribution to climate change. It is an imperative that applies equally to the consumers of fashion. Only through developing a greater awareness amongst consumers about the impact their return choices have upon the environment will a change in behavior occur.

Cost of return vs benefit of a size and fit solution

According to a recent survey by a leading global shipping and mailing company online returns cost retailers an average of 21% of order value14. At a more granular level, return processing costs are estimated to fall within a range of £10 to £20 per item,13 alternatively $10 to $20 before the cost of shipping.

Looking at the problem of cost from a different angle EyeFitU modeled the financial benefits achieved from deploying the EyeFitU SizeEngineTM at our many customers. Using the following customer KPIs that are easily obtained from Google Analytics:

◆ 30% – Website Visitors who used the Size Widget.

◆ 55% – Reduction of sizing returns.

◆ 15% – Conversion rate improvement.

◆ 45% – Increase in Average Order Value.

EyeFitU SizeEngine yielded a significant return on net sales (gross e-commerce sales less discount less returns) of 7,88% – USD$78 800 per USD$1 million in net sales.

Focus upon proven technology

From a returns perspective, retailers should therefore focus on the best-practice tools that are possible with existing technology instead of waiting for the many as-yet-unproven technologies that are still in the development phase.

EyeFitU SizeEngineTM is a proven technology.

1 Statista – The Statistics Portal. (n.d.). Statista. Retrieved October 2022, from https://www.statista.com/markets/415/topic/466/apparel-shoes/

2 Global fashion e-commerce market size 2021-2025. (2022, March 28). Statista. https://www.statista.com/statistics/1298198/market-value-fashion-ecommerce-global/

3 E-commerce Apparel Market Size & Share Report, 2028. (n.d.). Retrieved October 2022, from https://www.grandviewresearch.com/industry-analysis/e-commerce-apparel-market-report

4 Inman, D. (2022, January 25). Retail Returns Increased to $761 Billion in 2021 as a Result of Overall Sales Growth. NRF. https://nrf.com/media-center/press-releases/retail-returns-increased-761-billion-2021-result-overall-sales-growth

5 The UK’s 2021 Serial Refunder Report. (2021, December 10). Paymentsense. https://www.paymentsense.com/uk/blog/uk-serial-refund-hotspots-2021/

6 How To Reduce Returns in E-Commerce Fashion | Avensia. (n.d.). Retrieved October 2022, from https://www.avensia.com/knowledge-hub/blog/posts/reduce-returns-in-fashion-with-pim

7 Latest Returns Statistics That May Surprise You. (2022, October 11). Meteor Space – Warehousing & Order Fulfillment Services in Ireland & Europe: Meteor Space. https://www.meteorspace.com/2022/08/25/latest-returns-statistics-that-may-surprise-you/

8 Statista. (2022, April 8). Global consumers reasons for returning clothes bought online 2021. https://www.statista.com/statistics/1300981/main-reasons-return-clothes-bought-online/

9 Team, P. (2022, July 27). The State of Apparel & Footwear Shopping in 2022. PowerReviews. https://www.powerreviews.com/research/apparel-footwear-shopping-survey-2022/

10 eCommerce Returns. (2022, May). Whistl. https://www.whistl.co.uk/research/ecommerce-returns

11 Bower, A. B., & Maxham, J. G. (2012). Return Shipping Policies of Online Retailers: Normative Assumptions and the Long-Term Consequences of Fee and Free Returns. Journal of Marketing, 76(5), 110–124. https://doi.org/10.1509/jm.10.0419

12 The state of returns in 2021: insights from our latest report. – Klarna UK. (2021, June 8). https://www.klarna.com/uk/blog/the-state-of-returns-in-2021/

13 Eley, J. (2022, July 23). Fast fashion retailers end ‘real pain’ of free returns. Financial Times. https://www.ft.com/content/792c2893-4108-4faf-abf7-128b1aeda6c2

14 Introducing: Returnament 2022. (2022, June 23). Pitney Bowes. https://www.pitneybowes.com/us/blog/returnament-2022.html

17 Mull, A. (2021, October 13). Free Returns Are Complicated, Laborious, and Gross. The Atlantic. https://www.theatlantic.com/magazine/archive/2021/11/free-returns-online-shopping/620169/

16 Returning to order: Improving returns management for apparel companies. (2021, May 25). McKinsey & Company. https://www.mckinsey.com/industries/retail/our-insights/returning-to-order-improving-returns-management-for-apparel-companies